Financial Portfolio Analysis and Risk Management

Financial portfolio analysis and risk management project. Utilize daily closing price data to analyze company performance in Tehran Stock Market. portfolio optimization, risk measures, and asset pricing models.(Github)

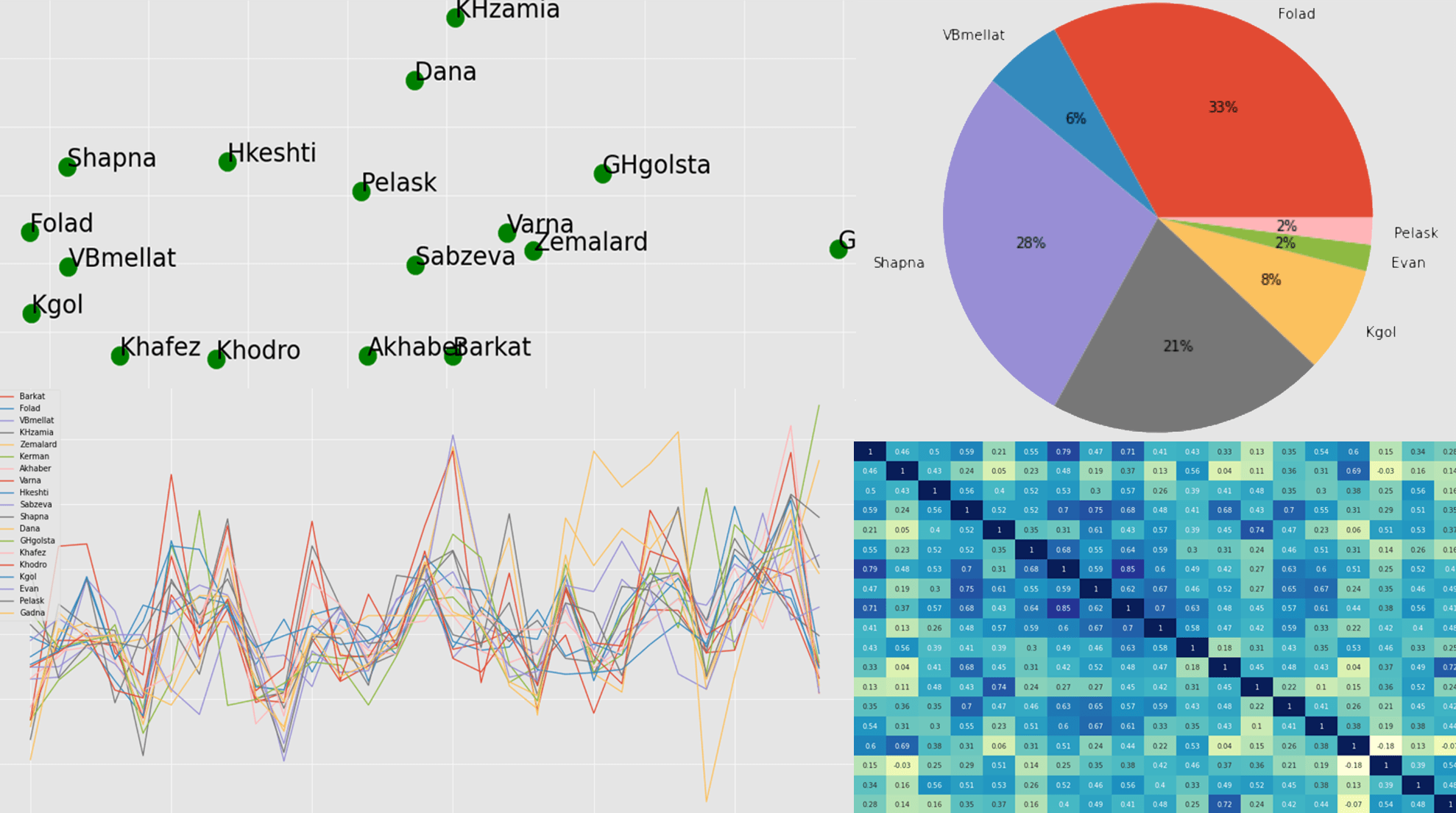

Descriptive Statistics and Performance Analysis:

- Calculate average and standard deviation of daily returns.

- Visualize company differences in average return and risk.

- Draw time graph of monthly returns.

- Report sample correlation matrix and graphical representation.

Portfolio Optimization and Efficient Frontier:

- Form optimal portfolios using minimum variance method.

- Consider long-only and short selling scenarios.

- Draw efficient frontier.

Capital Market Line and Borrowing/Lending:

- Integrate risk-free asset and form capital market line.

- Identify key portfolio points on the line.

Security Market Line and CAPM:

- Calculate beta values and standard deviation for CAPM.

- Interpret stock types (neutral, aggressive, defensive).

Risk and Performance Metrics:

- Calculate Treynor ratio, Sharpe ratio, and Jensen’s alpha.

Inflation and Single-Factor Models:

- Plot monthly return data against inflation index.

- Fit single-factor model with inflation as predictor.

- Estimate systematic and company risk.

- Overlay fitted line on the graph.

Arbitrage Pricing Theory (APT):

- Fit APT model based on results and interpret outcomes.

Value at Risk (VaR) Calculation:

- Calculate daily VaR using historical, parametric, and Monte Carlo methods.

- Report monthly risk value for 1 million toman investment.

- Calculate VaR for portfolio from previous question.

- Perform VaR backtesting.